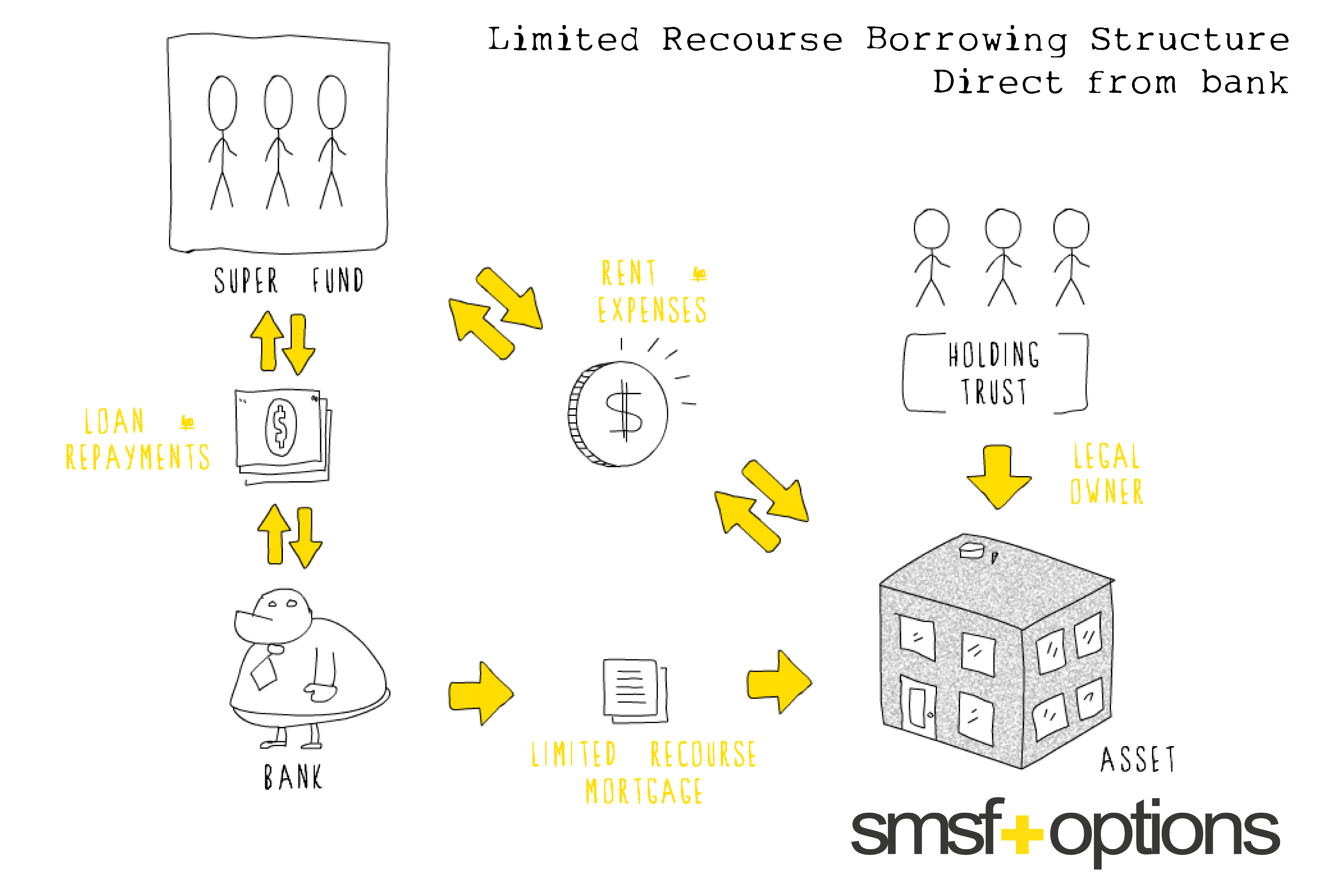

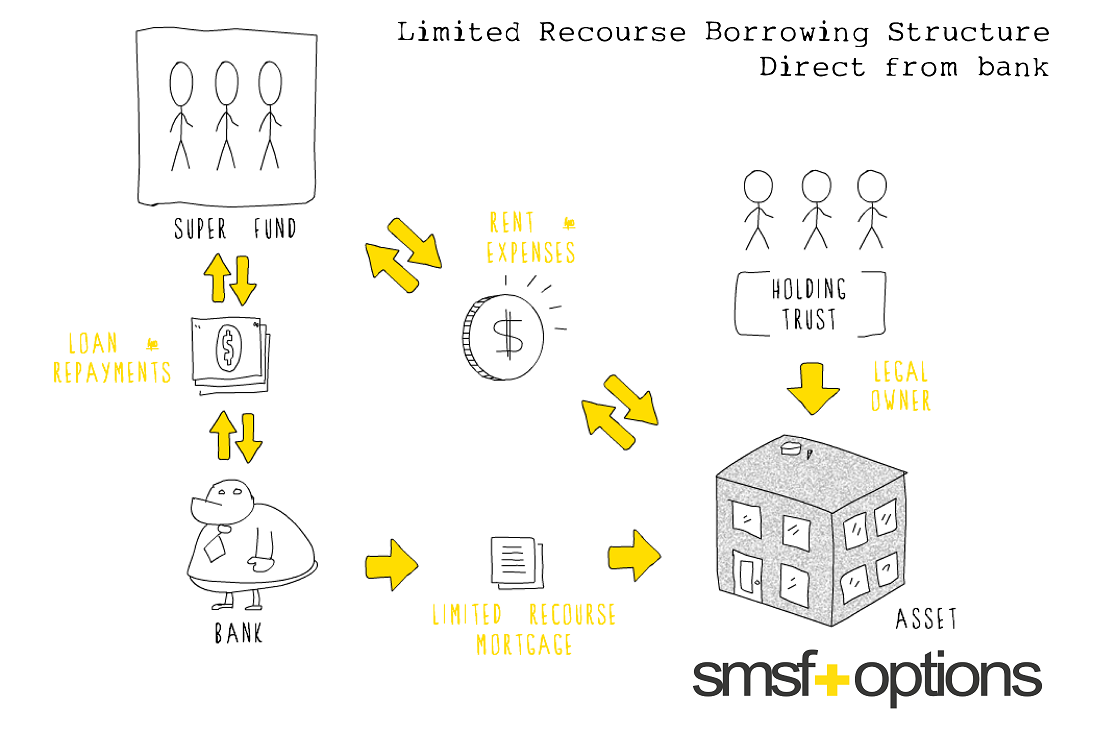

Although Self-Managed Superannuation Funds (SMSFs) are normally not allowed to borrow, there are some important exceptions to this rule. One such exception, which has received plenty of attention in recent times, is an “Limited Recourse Borrowing Arrangements” (LRBA), which gets its name because the rights of the lender against the SMSF trustee are limited if the SMSF defaults on the loan.

Although Self-Managed Superannuation Funds (SMSFs) are normally not allowed to borrow, there are some important exceptions to this rule. One such exception, which has received plenty of attention in recent times, is an “Limited Recourse Borrowing Arrangements” (LRBA), which gets its name because the rights of the lender against the SMSF trustee are limited if the SMSF defaults on the loan.

Used in the right circumstances this strategy can assist members to grow their retirement savings. However there are many risks and issues that should be considered before embarking on this strategy.

Borrowing arrangements that do not comply with the law can cause considerable problems for SMSFs and some trustees may not be aware of the serious consequences. Some of these arrangements, if structured incorrectly, cannot simply be restructured or rectified and can result in the SMSF needing to sell the property at a substantial loss.

Given the growing focus on these strategies at seminars and in the media, and the serious consequences if the rules are not followed, it is essential to seek specialist advice well before to signing a contract on a property.

Some important questions you should ask before entering in to this arrangement may include:

+ Does my Self-Managed Super Fund Trust deed allow me to borrow?

+ Can the asset I want to buy in the fund be acquired?

+ Are any property alterations required and are they allowed?

+ How will improvement costs be funded?

+ What are the ‘other’ costs involved?

+ Will the fund have sufficient liquidity?

+ What are the correct steps in setting up this structure?

+ When can I make an offer and sign a contract on the property?

+ Are there any tax loss capital gains considerations?

If you would like to learn more about SMSF LRBA’s and the benefits and risks specific to your circumstance, please contact Guy Wuoti at smsf+options by filling in your details below or by clicking here.

Alternatively, download one of our information handouts below so you can learn more about SMSF LRBA’s at home.

[contact_form email=”enquiries@smsfoptions.com” subject=”Tell me more about LRBA’s”]

You must be logged in to post a comment.