by Guy Wuoti | Tue, Jun, 2016 | SMSF News, SMSF Options, Tips and traps

The decision made by voters in the United Kingdom (UK) last week to leave the European Union (EU) – known as Brexit – has had an immediate and momentous impact on financial markets across the globe. The UK leaving the EU is one of the most significant political...

by Guy Wuoti | Tue, May, 2016 | SMSF News, SMSF Options

A reduction in concessional contribution caps, the lowering of the Division 293 tax threshold, capping tax-free assets in retirement and a lifetime limit for non-concessional contributions are just some of the changes that were in the Government Budget announcements...

by Guy Wuoti | Mon, Oct, 2015 | Adviser, Investments, SMSF News, SMSF Options, SMSF Setup, Tax, Tips and traps, Trustee

Individual vs Corporate Trustee… You have been weighing up the pros and cons of running your own a Self-Managed Superannuation Fund (SMSF) for some time now and you have reached the point where you think, Yes a SMSF is right for me. Fantastic, what’s next?...

by smsfoptions | Fri, Jul, 2014 | Boosting your Balance, Borrowing, Property, SMSF Options, Tips and traps, Trustee

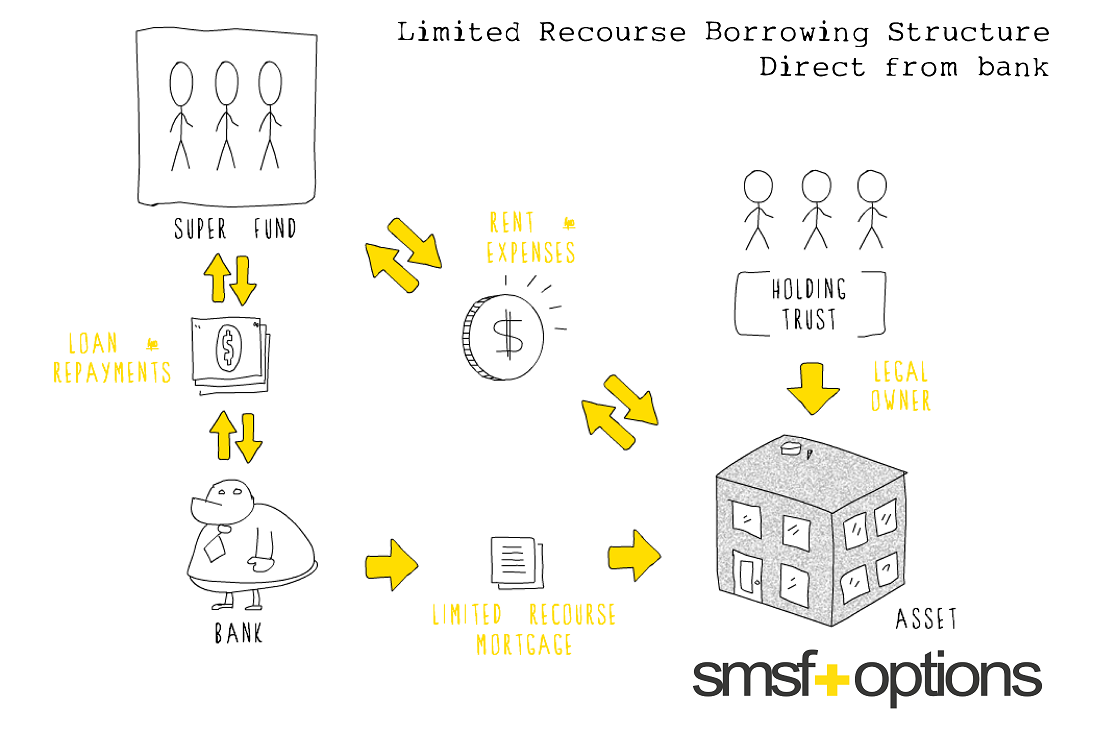

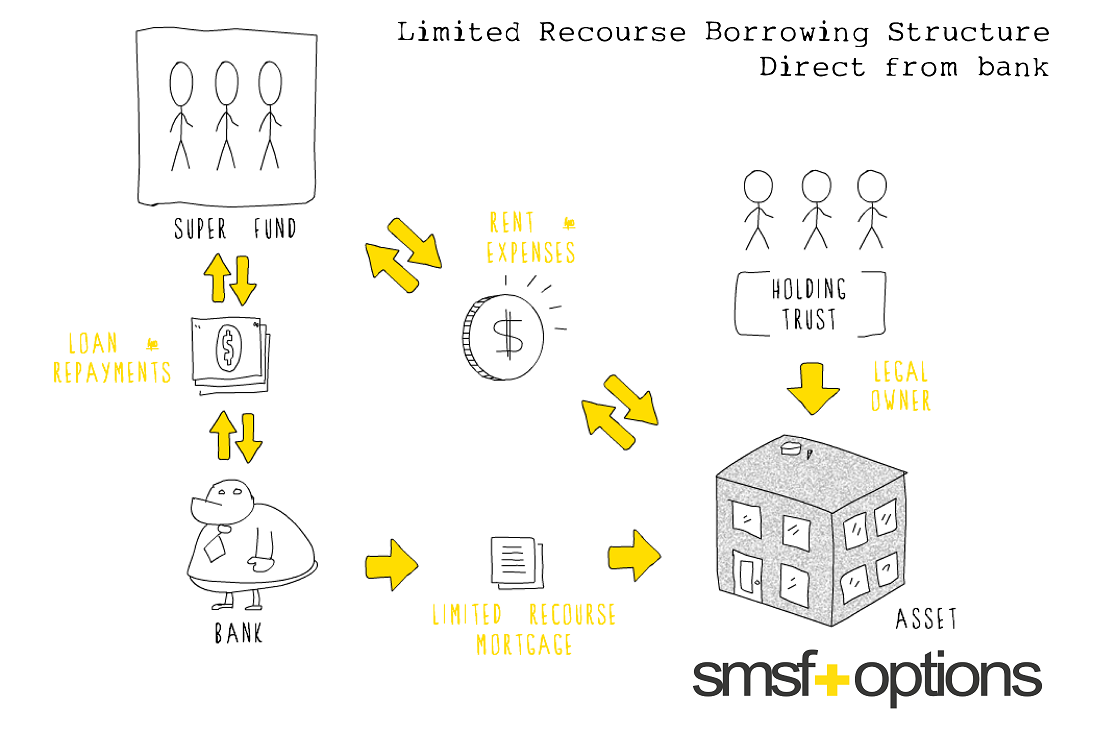

Although Self-Managed Superannuation Funds (SMSFs) are normally not allowed to borrow, there are some important exceptions to this rule. One such exception, which has received plenty of attention in recent times, is an “Limited Recourse Borrowing Arrangements” (LRBA),...

by smsfoptions | Fri, Sep, 2013 | Property, SMSF News, SMSF Options, Tips and traps, Trustee

Recent media has focussed on the risks of investing in geared property by self-managed superannuation funds (SMSFs) and whether it is really the right long-term decision for a member’s retirement. It can be the right choice for some but it’s not for everyone. ...