Whenever there is a discussion on Self-Managed Super nowadays, at some point the topic of cost will work its way into the conversation. Should I setup a SMSF – what will it cost compared to a public fund, how much will it cost to setup, how much will it cost to administer?

Whenever there is a discussion on Self-Managed Super nowadays, at some point the topic of cost will work its way into the conversation. Should I setup a SMSF – what will it cost compared to a public fund, how much will it cost to setup, how much will it cost to administer?

All valid questions and something that should not be discounted, however providing an accurate answer is a little more challenging when the costs of all the above vary so much across the industry.

Why is there such a huge variance in the SMSF industry?

Maybe your accountant is using stone aged systems to process your fund? Or maybe it’s because of the foreign options you have been investing in? There is no definitive answer to this question which is little help to all the SMSF trustees out there, so to gain some insight we should first look at what is required to administer your fund.

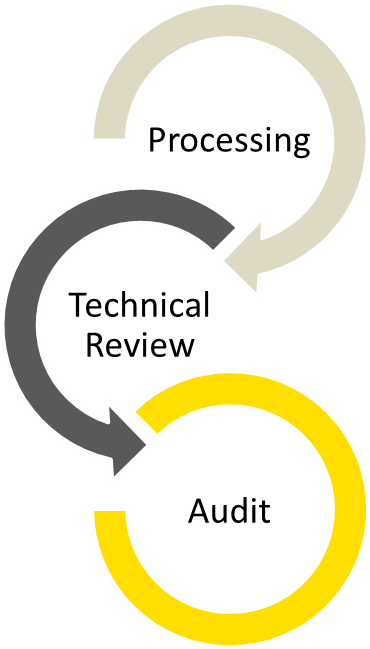

The three stages

All SMSFs have strict tax, compliance and financial reporting requirements that are required to be audited annually. Therefore if we could break the administration step down into 3 unique stages, it would look something like this:

Processing Stage

The first stage of the administration process begins with the input of your fund’s bank statements and transactional data into the administrator’s in-house software. This includes information such as interest, rent, dividends, expenses, purchase and sales processed in one, or a combination following ways:

1. Manually entered

2. Manually entered by an overseas outsourcer

3. Electronically via your bank or financial institution.

This input stage alone will vary drastically in terms of costs. Manual entry is time consuming so anything conducted in Australia incurs high labour costs compared to outsourcing to India or Vietnam as an example. Outsourcing manual administration procedure overseas is nothing new nowadays but many trustees question the level of security over their financial data.

Direct electronic data feeds from your bank or financial institution on the other hand will reduce the manual handling and costs, but data feeds are not always available for investments such as direct property or overseas assets.

The value of your fund should not impact your costs during this stage, but this is a labour intensive process so as a rule thumb; the greater the number of investments or transaction, the higher the costs when it is being when manually entering the data into the system.

Technical Review Stage

First off we need to ask, is you administrator skipping this stage? Over the years, the vast majority of problem funds that have come across by desk are those inherited from one of the low cost administration providers. Unbeknown to the trustees, the administrators were providing the processing stage only; what happened after that was not their problem.

This is fine for those that are technically capable of understanding the super rules and want to run their fund as cheap as possible, but for those that are not, the consequences can be severe.

At this stage, a SMSF Specialist will need to review the tax, financial reporting, compliance and audit matters. They will take a holistic approach by looking at other areas, such as such as long term succession planning and tax minimisation strategies. Without going overboard, this is a stage where you seriously need to consider the capabilities of your adviser vs any potential savings of a part-time tyre kicker. Are they a recognised SMSF specialist or are they a property developer with a calculator?

One of the easiest ways to blow costs during this stage is to have errors that are discovered 12 months after the event. By communicating with your adviser or moving to monthly administration, they will be more actively involved in the management of your fund and will be able to identify potential issues much sooner and save you money.

Also ask if your intended investment will impact your administration or audit costs? Certain assets are far more difficult to process, review and audit than others, so find out beforehand.

Audit Stage

If you are engaging an administrator to look after your fund, the chances are they will also arranging an auditor on your behalf. As such you might think you have very little influence over cost during this stage. The reality is that the audit stage is directly linked the first two stages, so any issues in processing and review will flow on to the audit and the costs associated with the review.

A SMSF audit can be broken down into two key areas.

1. Financial Statement audit

2. Compliance audit.

As the name suggests, a financial statement audit involves performing procedures to obtain sufficient audit evidence. The more difficult it is to obtain evidence, the more work the administrator will need to do. Complex or exotic investments such as cattle, wine, artwork or related party investments are usually going to be difficult to verify the existence and valuation at 30 June each year, so they will be more expensive to audit.

Likewise compliance flows directly from the technical side of running a SMSF. Investments that are complex in nature, or are prone to errors will require greater scrutiny. Investments such as options trading, borrowing arrangements or related party investments will always get more attention than the vanilla investments such as ASX listed shares.

The easiest way to save money in this area is to keep it simple. This by no means suggests you should limit your investments options; flexibility is the whole point of having a SMSF in the first place. But make sure you do your homework and talk to your adviser and auditor beforehand, so there are no nasty surprises.

Top 10 Tips to reduce your SMSF administration costs

1. Be prepared – keep track of your SMSF documentation or engage an administrator that will do it for you.

2. Look at electronic data feeds – It may save someone having to enter all your transactions each year and will keep you data in Australia. It will also provide additional audit evidence.

3. Consider moving to monthly administration – Often it costs less than annual administration and will provide you with up-to-date information.

4. Educate yourself – attend free web/seminars on Self-Managed Super. It will assist you in getting things right and staying within the rules.

5. Look at your technical capabilities of you SMSF accountant or administrator. Are the recognised as a specialist in this field? Cutting corners in this area may end up costing you more in audit costs, tax or even penalties.

6. Keep it simple and discuss the audit requirements with your SMSF adviser beforehand. Find out how much extra the foreign options or unlisted investment will cost you in administration and audit fees before you go ahead with the purchase.

7. Meet your reporting deadlines – this avoids snowballing potential compliance issues.

8. Ask you adviser if there is anything else you can do to make their life easier. Simply providing that additional report that you thought wasn’t important may save your administrator looking for it each year.

9. Request joint meetings between your accountant, administrator and financial adviser. This will allow the professionals to work better together and avoid doubling up on services.

10. Engage yourself with your fund. At the end of the day you are ultimately responsible, so don’t just sign documents without truly understanding what it all means.

Next Step

For more information on how smsf+options can assist you in reducing your SMSF administration costs, Contact us today.

You must be logged in to post a comment.