Blog & Resources

Stay Up to Date!News

10 Tips to reduce your SMSF administration costs

Whenever there is a discussion on Self-Managed Super nowadays, at some point the topic of cost will work its way into the conversation. Should I setup a SMSF – what will it cost compared to a public fund, how much will it cost to setup, how much will it cost to...

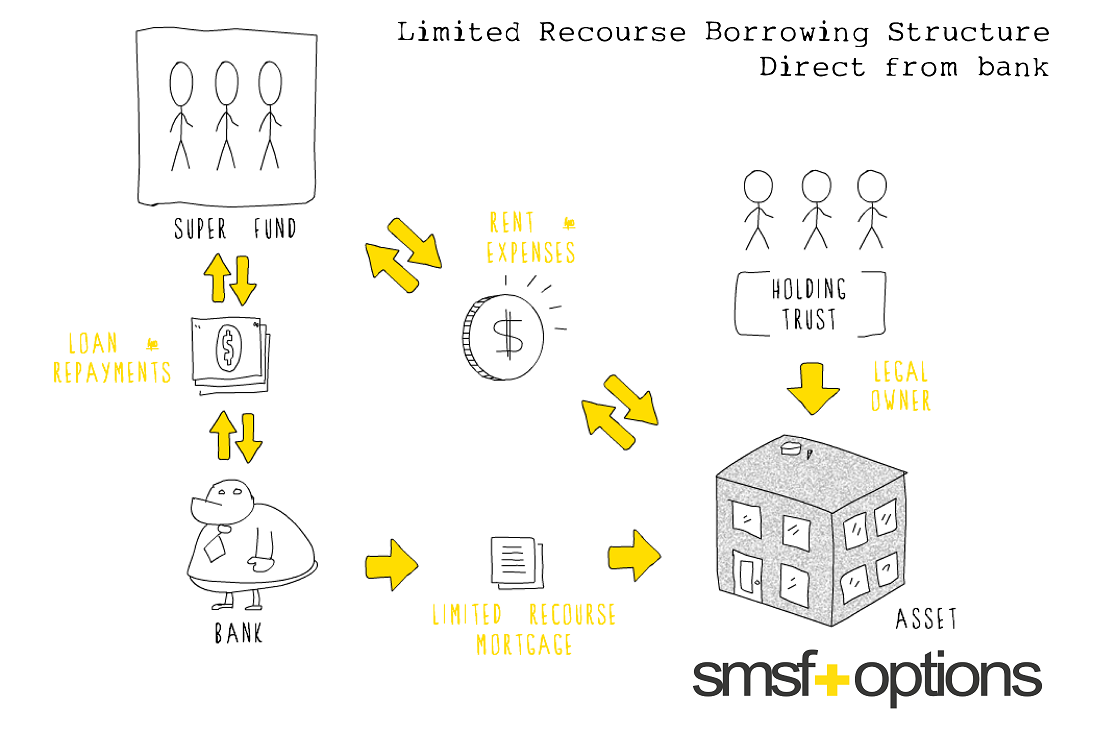

A Simple Guide to Borrowing in SMSF

Although Self-Managed Superannuation Funds (SMSFs) are normally not allowed to borrow, there are some important exceptions to this rule. One such exception, which has received plenty of attention in recent times, is an “Limited Recourse Borrowing Arrangements” (LRBA),...

New ATO Penalties for Self-Managed Super Funds

The ATO has introduced new penalty powers which it can impose on you if your fund breaks certain superannuation rules. The new rules apply from 1 July this year and allow the ATO to fine you and require you to rectify the mistake that has been made. They can also...

Government Tax and Superannuation

On Wednesday 6 November 2013, the Treasurer, the Hon Joe Hockey MP, and the Assistant Treasurer, Senator the Hon Arthur Sinodinos AO, announced the Government’s decision to abandon some of the previous Government’s tax and superannuation proposals. The announcement...

Are all ‘Fund’ expenses tax deductible?

Have you recently seen advertising inviting you to attend a conference or seminar to educate you about self-managed superannuation funds (SMSFs)? Your SMSF pays for the privilege of attending the 'conference' in Australia or overseas and you take a holiday as well,...

SMSFs and Property Investments

Recent media has focussed on the risks of investing in geared property by self-managed superannuation funds (SMSFs) and whether it is really the right long-term decision for a member’s retirement. It can be the right choice for some but it’s not for everyone. ...

SMSFs and Related Party Transfers

Earlier this year, the Government began moves to ban off-market transfers of assets to self-managed superannuation funds (SMSFs) from related parties. A related party of your SMSF broadly includes any other member of the SMSF, an employer that contributes to the fund...

Get a FREE eBook on How to buy property

in a SMSF (Coming soon…)

Subscribe

Office

- Currumbin – Gold Coast

AUSTRALIA

Contact Us

- hello@smsfoptions.com

(07) 5521 0029