I would like to purchase property in my super fund; however my fund does not have sufficient money to finance the property. Are there any alternatives to borrowing in super?

The simple answer is yes.

While the merits of each alternative is subjective to your individual circumstances, a brief summary of the advantages and disadvantages of each are discussed below.

*for further info on borrowing in super, check out simple guide to borrowing in a SMSF here

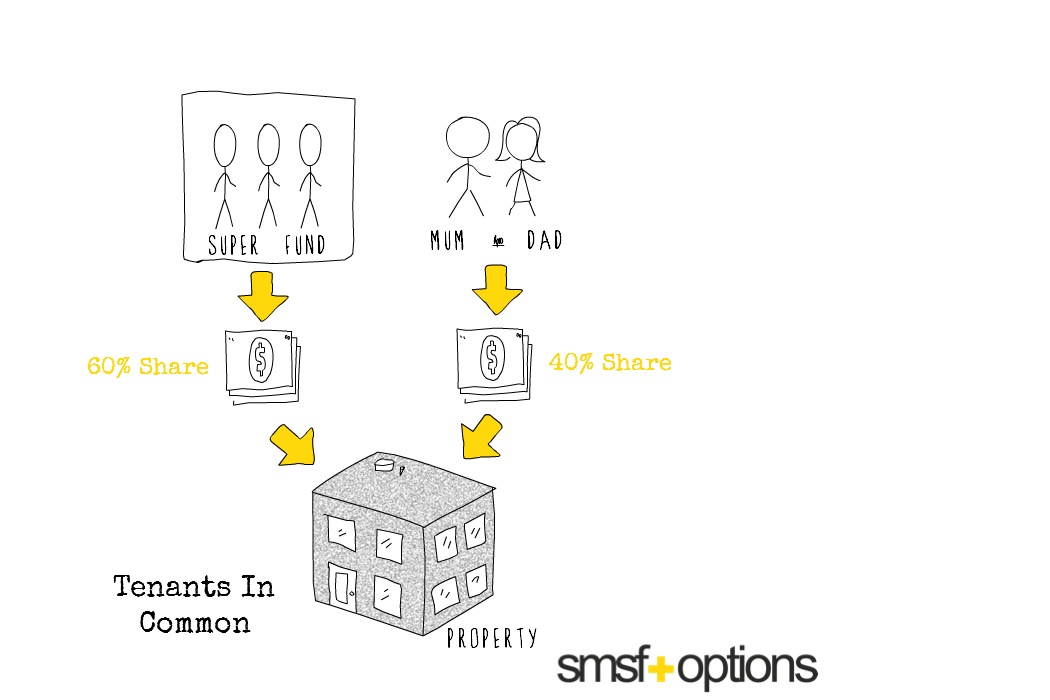

Tenants In Common

A cheap and easy alternative to a Limited Recourse Borrowing Arrangement is simply purchasing the property as Tenants in Common with another party. Under this arrangement, the property would be purchased and held in equal or unequal shares with two or more parties; utilising the capital of each party to purchase the property outright without borrowings.

Normally entering into any sort of partnership with another entity will result in the investment becoming an in-house asset which is limited to 5% of the fund’s assets. However this arrangement has specific exemption under the super rules.

Advantages

- Cheap and easy to establish this structure

- Perfect for when the fund doesn’t have sufficient cash to finance the asset purchase outright

- No restrictions on improving the asset

- Can purchase the property with a related party or unrelated party

Disadvantages

- The asset cannot be used as security by any party, so capital is required

- Unless the asset is considered business real property, the fund is prohibited from acquiring a greater interest in the property from the other party. This will require both parties to share property costs and distributions equally which can easily lead to an inadvertent breach of the rules if not done correctly.

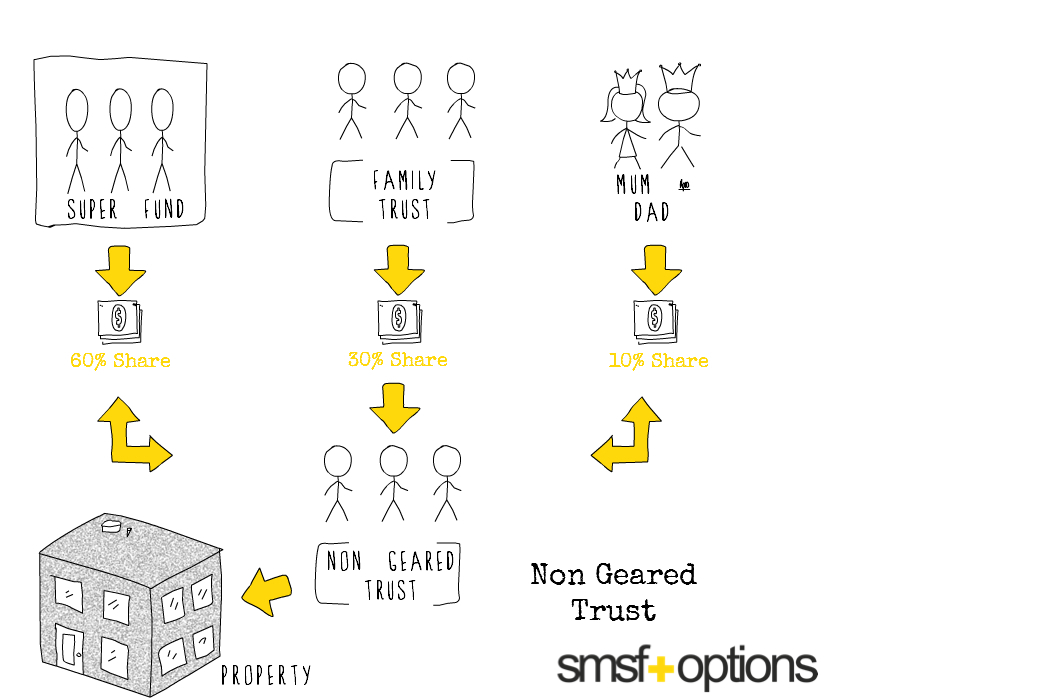

Non Geared Unit Trust

Another relatively cheap and easy alternative is purchasing the property in a non-geared unit trust with another party. Unlike the unrelated trust arrangement ( as discussed below), if the fund satisfies the requires of a non-geared unit trust, the other party maybe a related party (such as a member of the fund or related business). Under this arrangement, the property would be purchased and held within the trust, with the super fund owning a share of units with the other party; utilising the capital of each party to purchase the units in the trust (and property) outright without borrowings.

To qualify as a non-geared trust however, strict conditions apply. The consequences for getting this one wrong can be severe; therefore professional advice should be sort before entering into this arrangement.

Advantages

- Relatively cheap to establish

- More flexibility than tenants common, particularly where rent/expenses need to be split amounts a number of investors

- Can purchase other parties share in the trust, even if a related parties

- No restrictions on improving the asset

- Can purchase the property with a related party or unrelated party

Disadvantages

- Ongoing costs, trust will require annual tax returns

- The trust must not borrow

- Property cannot be used as security, however can have security over units in the trust

- To qualify as a non-geared trust, strict conditions apply. If at any time these conditions are not met, the trust will lose its exemption and will never again be eligible. In this event, the trust would be treated as an in-house asset which is limited to 5% of the fund’s assets. Professional advice is recommended with this arrangement.

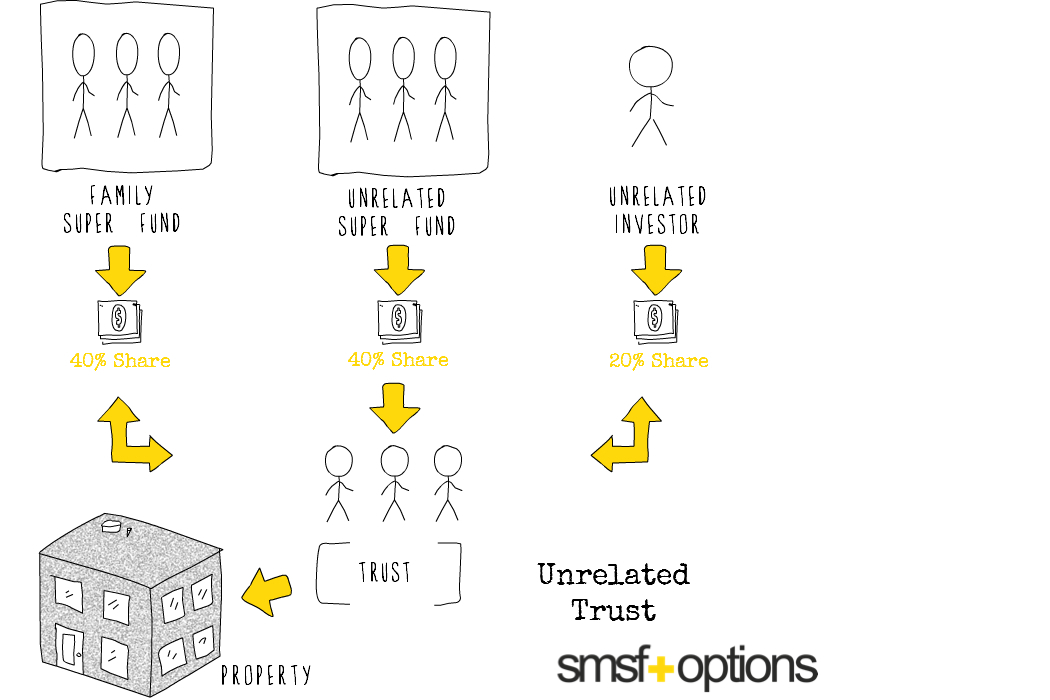

Unrelated Unit Trust

The most flexible arrangement to purchase property without borrowings would be via a unrelated unit trust. Under this arrangement, the property would be purchased and held within a trust, with the super fund owning a share of units with another party; utilising the capital of each party to purchase the units in the trust (and property) outright.

A key difference between an unrelated unit trust and a non-geared unit trust as mentioned above is that the other unit holders can be related parties with a non-geared unit trust. To satisfy the requirements of an unrelated unit trust, the super fund and/or its associates must not be in a position to control that trust. This means the fund and/or its associates must:

- hold no more than 50% of the unitrs in the trust,

- not control the trustee of the trust, and

- not be able to change the trustee of the trust.

Put simply, the fund is required to make the invest with unrelated parties.

Unrelated unit trusts are not restricted on what they can invest in; therefore the trust itself is permitted to borrow if desired, despite the superannuation fund being a unit holder. However, anti-avoidance rules may apply so care should be taken to ensure the investment remains compliant.

Advantages

- Relatively cheap to establish

- Most flexible structure

- Trust can borrow and act as a business in its own right

- Can use the property as security

- No restrictions on improving the asset

- Can purchase units in the trust from a the other parties, but not more than 50%

Disadvantages

- Ongoing costs, trust will require annual tax returns

- Requirement to invest with unrelated parties

- Super fund and/or is related parties and associates must not hold more than 50% of the units in the trust, must not control the trustee of the trust and must not be able to change the trustee of trust.

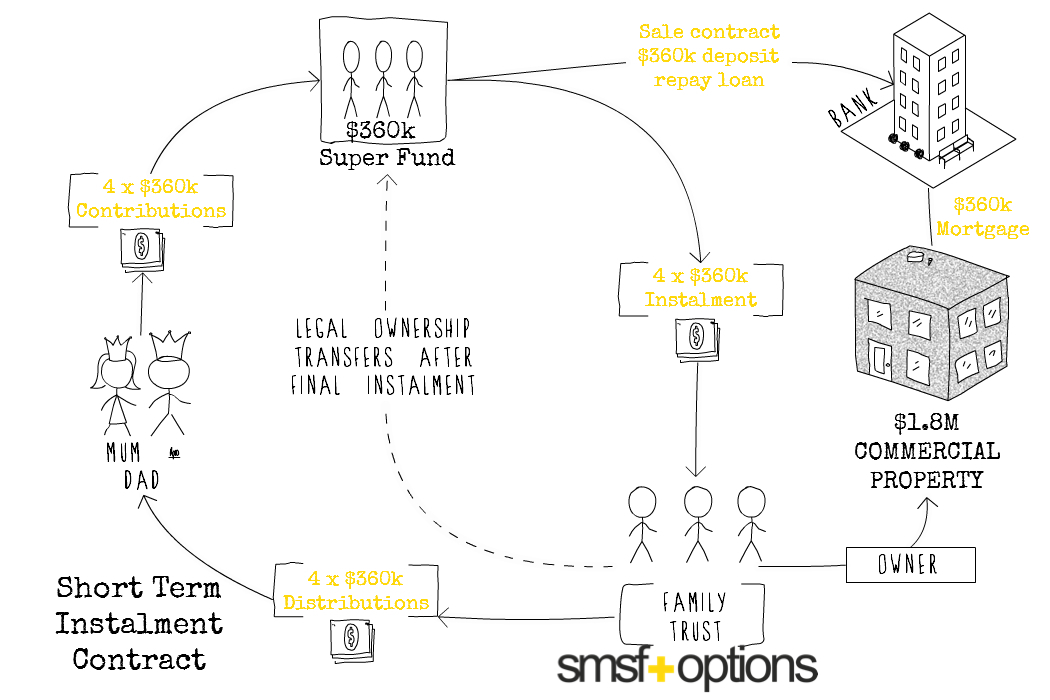

Instalment Contract

A common scenario for small business owners is to own their existing business premises personally or through a trust arrangement. In this example, it may be possible to purchase the property under an instalment contract, where the purchase price is paid, as the name suggests, though a number of instalments.

Under this arrangement, the instalment contract allows the SMSF to use its available cash to pay a first instalment to the vendor. The vendor than distributes to the beneficiaries of the trust, with a contribution made back to the super fund in round robin process until the purchase price is paid in full. Settlement does not occur until the final instalment is paid.

Certain rules govern instalment contacts from state to state; therefore it is important to obtain professional legal advice before proceeding with this arrangement.

Advantages

- Not a borrowing, but rather an acquisition of an asset by way of instalment payments.

- Ability to transfer existing commercial property into the super fund when the SMSF has insufficient money to finance the property.

- No refinancing fees or bank application fees in setting up a loan

- No new Corporate Trustees required

- Money kept within family group, rather than being paid to an outside financier

- No restrictions on improving the asset

Disadvantages

- Potential property law issue; what if the property is sold prior to instalments being paid.

- Essential to ensure the arrangement is on commercial terms when related parties are involved.

- Can be complex – potential sole purpose and financial assistance issues may arise

- Suits specific arrangements

What’s next

If you would like to learn more about transferring property into your super fund and the benefits and risks specific to your circumstance, please contact Guy Wuoti at smsf options by clicking here.

You must be logged in to post a comment.